Who Needs Instructions for Form 1125-E?

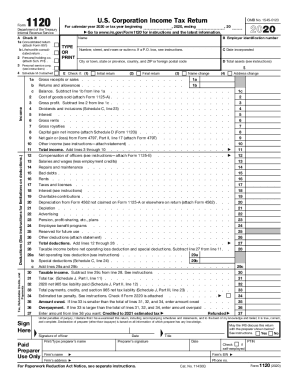

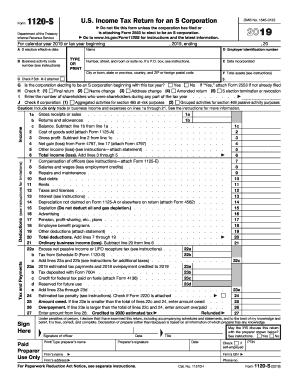

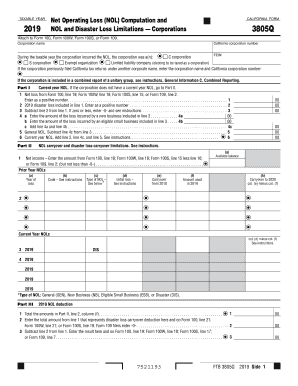

Form 1125-E is a certain attachment to the other statements like 1120-RIC, 1120, 1120-F, 1120-S, 1120-C and 1120-REIT. Consequently, all those applicants who deal with at least some of these templates should also file the Compensation of Officers one. It is required when the entity possesses general receipts of $500,000 and even more and implies officer compensations.

What is Form 1125-E Intended for?

The majority of the contemporary entities make use of the unique Form 1125-E to provide adequate reports according to the compensation of the officers they hire.

When is the Form Due?

Considering Form 1125-E, it is complicated to mention precise time limits. They can depend upon many factors, including contracts.

Is It Accompanies by Other Forms?

As far as it has been already signified, Form 1125-E is particularly a supplement to many other statements. Thus, it has less worthiness than those fundamental forms it can be attached to.

How to Fill Out Form 1125-E

Initially, the name and the identification number of the employer are enumerated. Then, an applicant can state all available officers with the required details. It also includes the SSN (Social Security Number), amount of time devoted to the businesses, percent of both preferred and common stock owned, and, consequently, the total of the compensation.

Who will Process Form 1125-E?

The Department of Treasury takes responsibility for Form 1125-E. So, in case you come up with some questions, you can contact the Internal Revenue Services support team, and they will provide you with all necessary information, including the addresses for sending this statement for confirmation.